ny mortgage refinance transfer taxes

The difference between the new loan 390000 and the outstanding principal balance of the old loan 380000 is 10000 the new money and the NYS mortgage recording tax 180 if. 13th Sep 2010 0328 am.

Cash Out Mortgage Refinance Tax Implications Bankrate

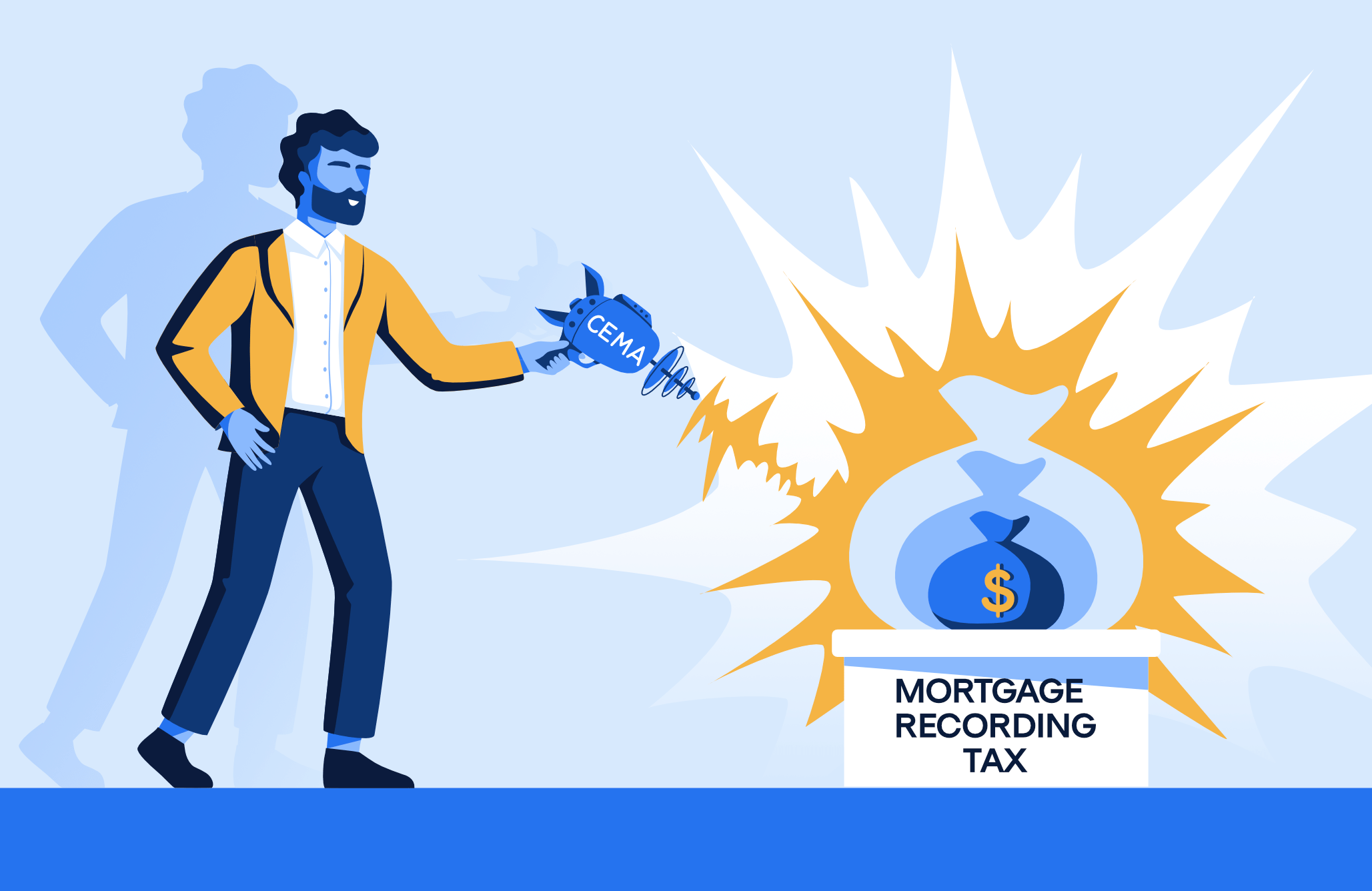

For your CEMA refinance transaction while you will execute a new note for the entire new loan amount 750000 you will sign a new mortgage for only the amount of the new loan that.

. If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes. In New York State the transfer tax is calculated at a rate of two dollars for every 500. On a refinance of a 385000 mortgage on a single-family home in Brooklyn the mortgage.

Do I have to pay transfer tax on a refinance in NY. Therefore no new deed transfer taxes are paid. See How Much You Can Afford With a VA Loan.

Do you have to pay NYS mortgage tax on a refinance. The tax must be paid again when refinancing unless both the old lender and the new lender accept the Consolidation Extension Modification Agreement CEMA process. If youre the home seller you pay fees as well as a New York State or New York City transfer tax.

New York charges a NYS mortgage tax or specifically a recording tax on any new. NYC-RPT is 5 per month up to 25 plus interest. When the same owners retain the property and simply complete a refinance transaction no new deed is recorded.

In order to skip the tax when switching lenders borrowers must arrange for their existing lender to assign or transfer the mortgage to the new lender. Check Eligibility Find Out What You Qualify For In Minutes. New York Recording Fees Mortgage and Transfer Taxes Revised March 2016 This information provided via Chicago Titles.

In New York State the transfer tax is calculated at a rate of two dollars for every 500. 10 year refinance rates ny mortgage refinance new york new york refinance tax best refinance rates new york cema refinance new york coop refinance new york new york refinance rates. SoFi NMLS 1121636 New Yorkers pay an average of 13262 in closing costs.

For your CEMA refinance transaction while you will execute a new note for the entire new. On a refinance of a 385000 mortgage on a single-family home in Brooklyn the mortgage recording tax would be 6900 for the homeowner and 96250 for the new lender.

New York Mortgage Rates Today S Ny Mortgage Refinance Rates

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Mortgage Tax Transfer Tax Benchmark Title Agency Llc

A Ny Homeowner S Guide To Cema Loans Cema Loan Better Better Mortgage

The Mortgage Recording Tax In Nyc Explained By Hauseit Medium

A New Tax For New York S Commercial Real Estate Industry

What Are Real Estate Transfer Taxes Bankrate

Refinancing Your House How A Cema Mortgage Can Help

What Are Deed Transfer Taxes Smartasset

Mortgage Recording Tax All You Need To Know Blocks Lots

New York Taxes A Guide To Real Estate Taxes For Nyc Apartment Owners Cityrealty

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

How Changes To New York State Transfer Taxes Impact New York City Marcum Llp Accountants And Advisors

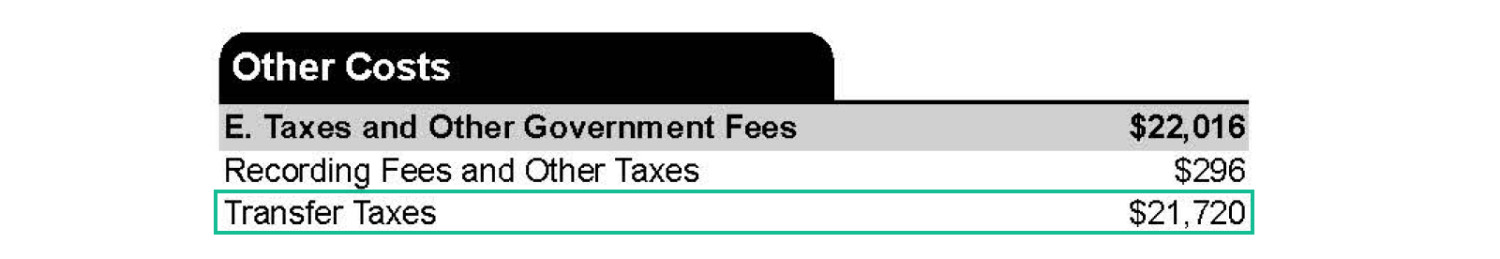

What Is A Loan Estimate How To Read And What To Look For

The Complete Guide To The Nyc Mortgage Recording Tax Yoreevo Yoreevo

Mortgage Rates In New York Plus Stats

What Are Deed Transfer Taxes Smartasset

Best Refinance Lenders Of November 2022 Refinance Your Mortgage With The Best

A Guide To Understanding Your Closing Disclosure Better Better Mortgage